Corporate ESG Reporting Standards Shift

Introduction: The Evolution of Non-Financial Disclosure

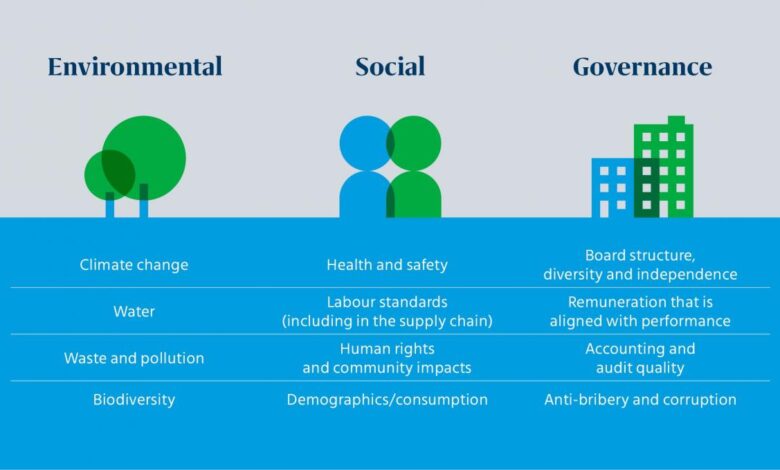

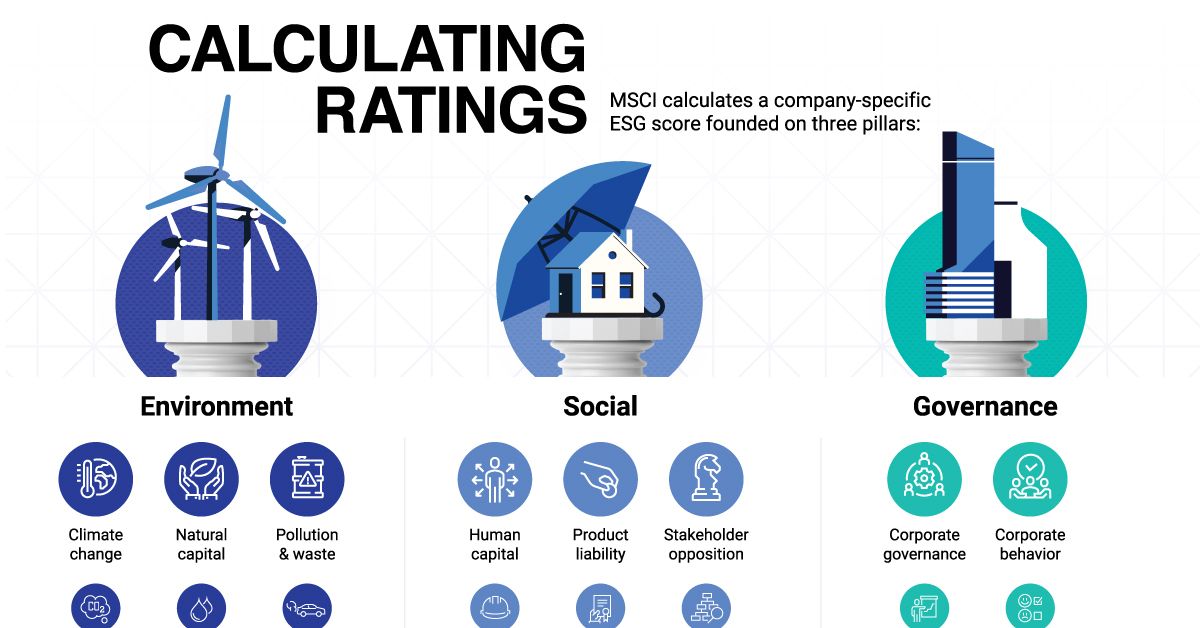

For decades, corporate success was primarily measured by financial performance alone. However, a profound and irreversible shift is underway. Stakeholders—including investors, regulators, employees, and consumers—now demand verifiable evidence of a company’s commitment to Environmental, Social, and Governance (ESG) criteria. The landscape is rapidly consolidating and maturing, necessitating a deep understanding of the Corporate ESG Reporting Standards Shift. No longer sufficient are qualitative, subjective reports; the market now demands data that is standardized, material, verifiable, and comparable across industries.

This comprehensive guide is designed for Chief Financial Officers (CFOs), Chief Sustainability Officers (CSOs), and corporate governance professionals who must navigate this complex transition. We will analyze the key drivers behind the shift, dissect the merging and consolidating regulatory frameworks, and provide a strategic roadmap for integrating these new, mandatory standards into core financial reporting. This detailed analysis aims to ensure compliance, unlock sustainable value, and capture the high-value search traffic associated with regulatory compliance and responsible investing.

Drivers Behind the ESG Reporting Revolution

The demand for better ESG reporting is not merely a trend; it is driven by powerful, persistent forces from both the regulatory and financial sectors.

A. Investor Demand for Materiality and Risk Assessment

Institutional investors are the primary catalyst, recognizing ESG data as crucial for risk-adjusted returns.

-

A. Risk Mitigation: ESG failures (e.g., climate damage, labor strikes, corruption) pose quantifiable financial risks. Investors use standardized ESG data to stress-test portfolios against physical climate risks (flooding, extreme heat) and transitional risks (policy changes, technology shifts).

-

B. Capital Allocation Decisions: Funds managing trillions of dollars are implementing sustainable investment mandates. They require standardized, audited data to compare companies reliably and allocate capital toward best-in-class sustainable performance, making non-compliance a barrier to accessing capital.

-

C. Fiduciary Duty Expansion: Many global pension funds and asset managers now recognize that considering ESG factors is an integral part of their fiduciary duty—a legal requirement to act in the best financial interest of their clients.

B. Regulatory Mandates and Jurisdiction Convergence

Governments and financial regulators are moving away from voluntary guidance toward mandatory disclosure rules.

-

A. Preventing Greenwashing: The lack of standards previously allowed companies to exaggerate or misrepresent their ESG efforts (“greenwashing”). Mandatory, prescriptive reporting aims to hold corporations legally accountable for their claims, imposing fines for misleading disclosure.

-

B. Financial Stability: Regulators recognize that systemic risks—particularly climate change—pose a threat to the stability of the entire financial system. Mandatory reporting ensures the risks held by corporations are transparently passed up to banks, insurers, and central banks.

-

C. Global Interoperability: The shift is towards creating a common language for ESG data to reduce the burden on multinational corporations reporting to numerous jurisdictions (e.g., EU, UK, US, Asia).

Analyzing the Key Standards Consolidation

The shift is defined by the convergence of once-disparate reporting frameworks into unified, mandatory standards.

A. The Consolidation into the ISSB Framework

The most significant recent development is the creation of the International Sustainability Standards Board (ISSB) by the IFRS Foundation, the same body responsible for global financial reporting standards (IFRS).

-

A. IFRS S1 (General Requirements): Sets out the core content requirements for disclosing material information about all sustainability-related risks and opportunities that could reasonably affect an entity’s cash flows, access to finance, or cost of capital over the short, medium, and long term.

-

B. IFRS S2 (Climate-Related Disclosures): This mandates specific disclosures related to climate-related risks and opportunities, building heavily on the existing framework established by the Task Force on Climate-Related Financial Disclosures (TCFD).

-

C. The TCFD Integration: The ISSB effectively absorbs the highly influential TCFD recommendations (Governance, Strategy, Risk Management, Metrics/Targets), making this climate-focused disclosure a global baseline.

B. The European Union’s CSRD and ESRS

The EU is leading the world with the Corporate Sustainability Reporting Directive (CSRD), which replaces the older NFRD and introduces the European Sustainability Reporting Standards (ESRS).

-

A. Double Materiality Principle: Unlike the ISSB/IFRS which focuses on “financial materiality” (how sustainability affects the company’s value), the CSRD/ESRS mandates Double Materiality. Companies must report on both:

-

How sustainability matters affect the company (financial materiality).

-

How the company’s operations affect people and the planet (impact materiality).

-

-

B. Scope and Assurance: The CSRD significantly expands the scope, requiring large companies and listed SMEs to report. Crucially, all reported information must be subject to mandatory external assurance (auditing) to ensure credibility, mirroring financial audits.

-

C. Granularity and Digital Tagging: The ESRS standards are highly prescriptive and require digital tagging of information (using iXBRL) to ensure data is machine-readable and comparable.

C. The U.S. Regulatory Landscape (SEC and State Actions)

While the U.S. federal regulation has faced political headwinds, the direction is clearly toward mandatory climate and human capital disclosures.

-

A. SEC Climate Rule: The Securities and Exchange Commission (SEC) has proposed rules to require public companies to disclose extensive climate-related information, including, potentially, Scope 3 greenhouse gas (GHG) emissions (emissions from the value chain).

-

B. California’s Climate Disclosure Laws: California has enacted state laws requiring large public and private companies operating there to report both their direct (Scope 1 and 2) and indirect value chain (Scope 3) emissions, forcing early action across the US.

-

C. Human Capital Disclosures: The SEC has focused on requiring better qualitative and quantitative metrics on human capital management, including workforce diversity, employee turnover, and skills development.

Strategic Roadmap for Compliance and Integration

Strategic Roadmap for Compliance and Integration

Successfully implementing the new ESG standards requires a multi-year, cross-functional organizational effort.

A. Embedding Governance and Oversight

Compliance begins at the highest levels of the organization.

-

A. Board Oversight and Competence: The Board of Directors must take ultimate responsibility for ESG oversight. This requires ensuring the Board has sufficient ESG expertise—often through the appointment of specialized board members or committees.

-

B. Cross-Functional Data Ownership: ESG data collection cannot reside solely within the Sustainability Department. It must be integrated with Finance (Scope 1 and 2 emissions data), HR (Social metrics), and Supply Chain/Operations (Scope 3 data).

-

C. Executive Compensation Alignment: Tying a portion of executive compensation (bonuses or stock options) to the achievement of material ESG targets (e.g., carbon reduction, diversity metrics) ensures accountability and strategic focus.

B. Data Collection, Quality, and Technology

The shift demands robust, auditable data infrastructure similar to financial systems.

-

A. Gap Analysis: Conduct a comprehensive gap analysis between current voluntary reporting practices (e.g., based on GRI or SASB) and the requirements of the new mandatory standards (ISSB/CSRD). Identify areas where data is missing or insufficient for audit.

-

B. Digital Data Infrastructure: Invest in centralized ESG data management software (SaaS platforms) capable of integrating with ERP and operational systems. This ensures data consistency, traceability, and the ability to apply required digital tagging formats.

-

C. Materiality Assessment Rigor: Conduct a detailed, verified double materiality assessment (especially critical for EU compliance) to pinpoint the specific ESG topics that are most relevant and impactful to the business and its stakeholders.

C. Assurance, Auditability, and Controls

The shift from voluntary disclosure to mandatory financial-grade reporting requires formal internal controls.

-

A. Internal Controls Development: Implement formal Internal Controls over Sustainability Reporting (ICSR). These controls mirror SOX (Sarbanes-Oxley) controls and ensure the reliability and accuracy of all ESG data from collection point to final report.

-

B. External Assurance Readiness: Prepare the company’s data and processes for mandatory external assurance. This involves working with financial auditors to establish the scope of the audit (limited or reasonable assurance) and remediating any internal control weaknesses identified.

-

C. Alignment with Financial Reporting: Integrate the ESG reporting cycle and data governance into the existing financial reporting calendar. For global companies, this means ensuring the ESG data cut-off date aligns with the financial year-end.

Leveraging ESG Reporting for Competitive Advantage

Leveraging ESG Reporting for Competitive Advantage

Compliance is the floor, not the ceiling. Strategic companies use high-quality ESG reporting to generate tangible business value.

A. Enhanced Access to Capital and Favorable Terms

High-quality, audited ESG data is becoming a prerequisite for favorable financing.

-

A. Green Bonds and Sustainability-Linked Loans (SLLs): Companies with credible, verifiable ESG metrics can issue green bonds or secure SLLs, which often offer lower interest rates or better lending terms compared to conventional financing, directly reducing the cost of capital.

-

B. Improved Equity Valuation: Studies show that companies with strong ESG profiles often achieve higher equity valuations because investors perceive them as lower-risk, better-managed, and more resilient.

-

C. Active Investor Engagement: Using the standardized ESG reports as a communication tool allows the company to proactively engage with large, long-term investors (e.g., sovereign wealth funds) who require this level of detail.

B. Talent Acquisition, Retention, and Operational Efficiency

ESG performance drives internal business value beyond the capital markets.

-

A. Talent Attraction: Younger, highly-skilled workers increasingly prioritize employers with strong, authentic social and environmental commitments. High-quality ESG reporting serves as a powerful recruiting and retention tool.

-

B. Operational Cost Reduction: ESG efforts, particularly those focused on environmental metrics, often lead to direct cost savings through energy efficiency, waste reduction, and optimized resource use (e.g., a push for Scope 1 and 2 emission reduction inherently lowers utility bills).

-

C. Supply Chain Resilience: Mandatory Scope 3 reporting forces companies to map and manage the sustainability risks (e.g., labor abuses, material scarcity) within their value chain, improving overall supply chain transparency and resilience.

Conclusion

The Corporate ESG Reporting Standards Shift marks the definitive end of the era of optional, fragmented disclosure. The convergence into mandatory, financially material standards (ISSB, CSRD) necessitates an immediate, comprehensive overhaul of corporate data governance, technology infrastructure, and internal control systems. Companies that view this change merely as a compliance burden risk losing access to capital and suffering reputational damage.

Conversely, those that strategically embed these new, robust standards—ensuring auditability, demonstrating double materiality, and leveraging the data for strategic decision-making—will gain a significant competitive edge, attract premium talent, lower their cost of capital, and cement their position as leaders in the sustainable economy of the future.